Asset Protection Behind the Corporate Veil

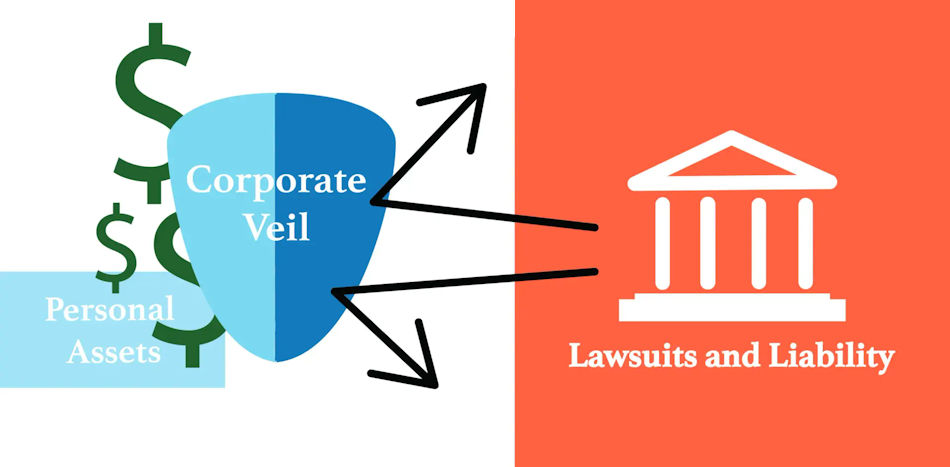

As a business owner, you’ve worked hard to accumulate assets and a comfortable life. But without proper asset protection, your personal and business assets are at risk. A proper strategy for protecting your assets begins by insulating personal wealth from business liabilities. This can be achieved through various legal structures, such as: Limited Liability Companies (LLCs), or Corporations. These structures create a “corporate veil” or legal separation between the company as a separate legal entity and the individuals who own it.

Most business owners have a serious misconception about this protection. Did you know that once your company is incorporated, the limited liability protection afforded by the incorporation process is NOT automatic? Incorporated entities do not automatically become barriers between your personal assets and your business assets. The company must comply with corporate formalities to enjoy limited liability protection for your personal assets.

Corporate compliance includes you treating your incorporated entity as completely separate from yourself. Otherwise, if your business is sued, the person suing may try to show the court that you have not maintained your business to the letter of the law, thus “piercing the corporate veil” and attaching your personal assets as part of a judgment.

While the laws vary from state to state, courts will generally abstain from piercing the corporate veil unless there have been signs of serious misconduct.

Below is a general overview of what you should do to keep your business in compliance with the law.

- File an annual report: Most states require some sort of annual report filing on the anniversary of your incororation date.

- File amendments for any changes. If you make major changes to your corporation, you may need to keep your state up to date with filing Articles of Amendment.

- Keep up to date with any meeting minutes. Record meeting minutes whenever you hold a corporate meeting. The minimum requirement regarding meeting minutes are the annual minutes, which appoint directors and officers.

- File DBA for any name variations: A business may have an official name and then use variants of that name or different names to do business. You should file a DBA (Doing Business As) with the county where you do business for each name used.

- Get an EIN: You must obtain a Federal Tax Identification number, also known as an Employer Identification Number (EIN). This nine-digit number is as important for your company as a social security number is important for you personally.

- Separate bank accounts. Open a separate bank account for your incorporated entity. This action separates your personal money from your business money and prevents any comingling. This will show separation from personal assets, thus proof of a separate entity existence for your business. Additionally, this action will allow your incorporated entity to start creating its own credit rather than using your personal credit.

- Use full legal name: The name of the corporation should be used in full, including “Inc.” Or “LLC,” on all contracts, invoices, and documents used by your company. This clearly indicates the existence of the incorporated entity as a separate entity.

- Use your title: Always use your title, such as President, Chief Executive Officer, or Secretary, when signing on behalf of your incorporated entity. Using the name of the corporation and your title further creates separation from you as an individual. Generally, by using your title, a person or entity suing you can only sue you as a corporate officer and not you, as an individual person.

- Federal Beneficial Ownership Information Reporting (BOIR): Most businesses must file an initial BOI report to comply with the Corporate Transparency Act (CTA). You only need to file a BOI report once, unless there are changes to the reported information.

Failure to file required paperwork can lead to fines and penalties, including suspension of your incorporated entity. By following these corporate compliance steps you can enjoy limited liability protection under the law. Of course, specific requirements will vary based on your business type and location.

Disclaimer: This information is made available by Bagla Law Firm, APC for educational purposes only as well as to give you general information and a general understanding of the law, and not to provide specific legal advice. This information should not be used as a substitute for competent legal advice from a licensed professional attorney in your state.